NIF

🚀 Get Your NIF Today - Stress-Free & Fast!

Your key to unlocking financial and legal activities in Portugal.

We offer free fiscal representation for the first year!

📩 Apply Now and simplify your relocation to Portugal.

Special Offer

💡 We offer free fiscal representation for the first year!

🚀 Get your NIF today – fast, stress-free, and fully compliant.

Your Essential Guide to the NIF Everything you need to start your life in Portugal

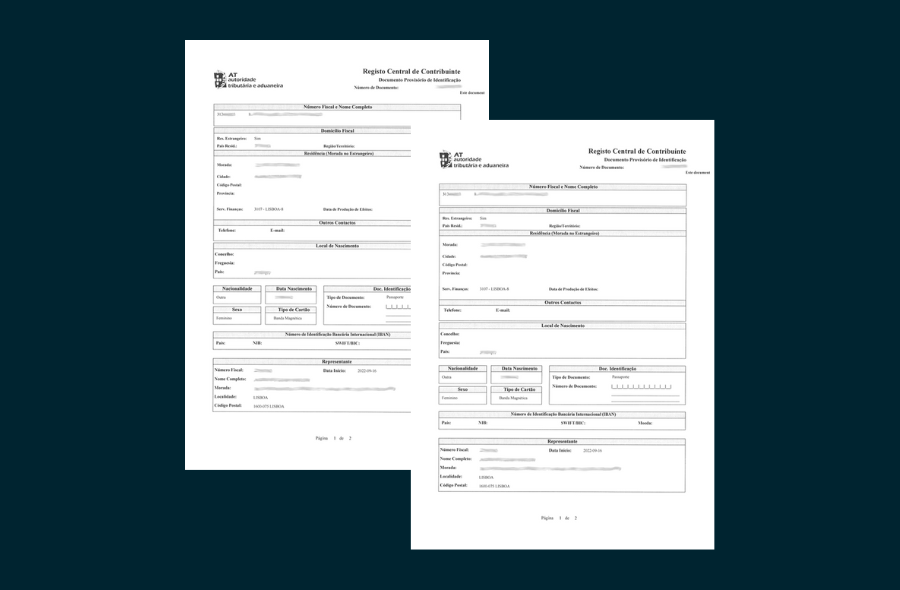

What is a NIF?

The Número de Identificação Fiscal (NIF) is a Portuguese tax identification number issued by the Autoridade Tributária e Aduaneira (Tax Authority). It is a mandatory requirement for obtaining a visa and is essential for many financial and legal activities in Portugal

✅ Visa & Residency Applications

🏦 Open a Bank Account

🏠 Property Purchase Assistance

💡 Tax Registration Support

📝 Signing Rental Agreements

⚡ Setting Up Utilities

Understanding the NIF

✅ Who Needs a NIF?

- Anyone applying for a visa or residency permit.

- Foreign nationals moving for work, residency, or study.

- Remote workers, freelancers, and business owners.

- Property buyers and investors.

Required Documents

📄 Valid passport (or EU national ID card).

📬 Proof of address (utility bill, bank statement, driver’s license).

🚀 Don’t let bureaucracy slow you down. Get your Portuguese NIF quickly and efficiently with our professional assistance.

Frequently Asked Questions

What is a NIF in Portugal?

The Número de Identificação Fiscal (NIF) is a Portuguese tax identification number issued by the Tax Authority (Autoridade Tributária e Aduaneira). It is required for various legal and financial activities, such as opening a bank account, signing contracts, purchasing property, and applying for visas.

Who Needs a NIF?

✔ Anyone applying for a visa or residency permit

✔ Foreign nationals relocating to Portugal for work, residency, or study

✔ Property buyers and investors

✔ Remote workers, freelancers, and business owners

Why Do I Need a NIF?

✔ To open a bank account

✔ To sign rental agreements

✔ To purchase property

✔ To set up utilities (electricity, water, internet)

✔ To register for tax purposes

What Documents Are Required to Get a NIF?

✔ A valid passport (or an EU national ID card)

✔ Proof of address (utility bill or bank statement)

✔ Fiscal representation for non-EU/EEA citizens

Do Non-Residents Need a Fiscal Representative?

Yes, non-EU/EEA citizens must appoint a fiscal representative to handle tax-related matters and stay compliant with Portuguese tax laws.

How Long Does It Take to Get a NIF?

The process typically takes a few hours to a few business days, depending on the application method and document verification.

Do You Offer Fiscal Representation Services?

Yes, we offer free fiscal representation for the first year to ensure compliance with Portuguese tax regulations.

How Can I Apply for a NIF Quickly?

Contact us today for a fast, hassle-free application process. We handle all the paperwork while you focus on relocating to Portugal.